A company’s balance sheet provides a snapshot of the assets it owns, liabilities it is responsible for, and whatever might be left over when subtracting assets from liabilities that represents owners' capital or shareholders’ equity. Combined, an analysis indicates its financial strength, whether it can meet its obligations and how it grows capital. Below is a more detailed analysis of the asset side of the equation.

Assets Overview

A firm uses its assets to generate sales and bottom-line profits (net income) for shareholders. A healthy company will continually grow its assets, by reinvesting profits back into the business. A very basic, high-level asset balance sheet will include a mix of current and non-current assets totaled to indicate a firm's total assets.Current assets are those that can be sold rather quickly, or specifically within a year. In fact, they will likely be turned into cash and consist of working capital items, which generally consist of raw materials that are turned into final products sold by the company. Non-current assets consist of items likely to be sold or used up after a year or much longer. These are also logically referred to as long-term assets.

Common Assets

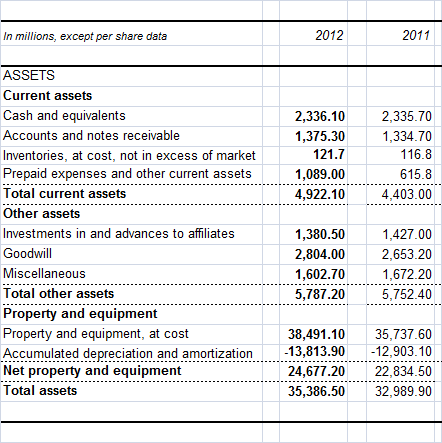

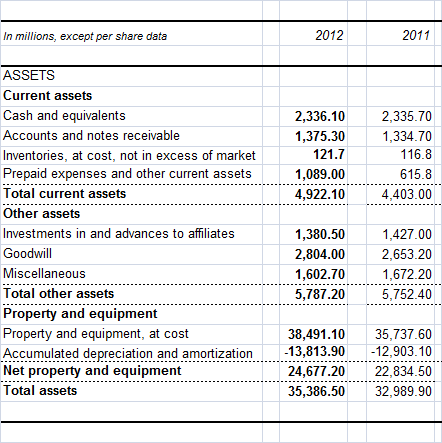

Below is an exhibit of fast-food giant McDonald’s (NYSE:MCD) balance sheet.

McDonald’s is a giant, globally diversified company with a market capitalization of nearly $100 billion. It operates a pretty straightforward business that runs restaurants and serves basic meals consisting of hamburgers, French fries and an increasing array of healthier items such as salads and smoothies.Balance sheets are organized according to estimates of how long the assets are expected to last

Balance sheet items can also be converted into ratios, which will help an analyst or investor investigate liquidity (the ability to cover short-term liabilities with short-term assets), solvency (the ability to finance long-term debt with profits) and how shareholder capital is being managed. From this perspective, assets form part of the equation and must be mixed in with liabilities and shareholders’ equity. Below is a current overview for McDonald's that indicates strong financial strength compared to rivals based on liquidity and solvency.

The Bottom Line

The takeaway for investors is that understanding how to review a firm’s assets is a valuable part of security analysis. The analysis cannot be in a vacuum as a company must be analyzed over time, such as quarterly or over a number of years by looking at its historical financials. A firm must also be compared to key rivals, which can help uncover inconsistencies or areas for further analysis.

Assets Overview

A firm uses its assets to generate sales and bottom-line profits (net income) for shareholders. A healthy company will continually grow its assets, by reinvesting profits back into the business. A very basic, high-level asset balance sheet will include a mix of current and non-current assets totaled to indicate a firm's total assets.Current assets are those that can be sold rather quickly, or specifically within a year. In fact, they will likely be turned into cash and consist of working capital items, which generally consist of raw materials that are turned into final products sold by the company. Non-current assets consist of items likely to be sold or used up after a year or much longer. These are also logically referred to as long-term assets.

Common Assets

Below is an exhibit of fast-food giant McDonald’s (NYSE:MCD) balance sheet.

McDonald’s is a giant, globally diversified company with a market capitalization of nearly $100 billion. It operates a pretty straightforward business that runs restaurants and serves basic meals consisting of hamburgers, French fries and an increasing array of healthier items such as salads and smoothies.Balance sheets are organized according to estimates of how long the assets are expected to last

- Current assets (less than a year) come first and consist of cash and marketable securities, the last of which are basically cash equivalents (items that can be quickly and readily converted to cash) such as money market funds or other very short-term securities. McDonald’s converts what its customers in line purchase (hamburgers, shakes, salads, etc.) at its restaurant into cash quickly, which means little risk to inventory or accounts receivable.

- Prepaid expenses may sound more complicated but are simply operating expenses that have been prepaid. Prepaid insurance is a good example because premiums may be paid for six months in advance, meaning they are prepaid for a number of months before they are recognized as an expense.

- McDonald’s other assets consist of its investments in affiliates that own and help operate its restaurants in countries throughout the world.

- Goodwill is a more complicated category. McDonald’s defines it as “the excess of cost over the net tangible assets and identifiable intangible assets of acquired restaurant businesses. The company's goodwill, an intangible asset that doesn’t have any physical characteristics (and also includes trademarks, trade names, or customer relationships), primarily results from purchases of McDonald's restaurants from franchisees and ownership increases in subsidiaries or affiliates.” This last part relates to its investments in affiliates, and goodwill overall means that McDonald’s has paid more for its acquisitions than is reflected on its balance sheets.

- Its miscellaneous category is a catchall area and includes derivatives it uses to hedge currency risk and commodity risks, such as the purchase of meat and potatoes for its burgers and French fries.

- On the long-term side of the asset equation (a year or more), McDonald’s property and equipment consists of its physical restaurants and all equipment inside. It depreciates these assets over time, which accumulates on the balance sheet and nets out in the final subcategory on its balance sheet.

Balance sheet items can also be converted into ratios, which will help an analyst or investor investigate liquidity (the ability to cover short-term liabilities with short-term assets), solvency (the ability to finance long-term debt with profits) and how shareholder capital is being managed. From this perspective, assets form part of the equation and must be mixed in with liabilities and shareholders’ equity. Below is a current overview for McDonald's that indicates strong financial strength compared to rivals based on liquidity and solvency.

| Ratio | Company | Industry | Sector |

| Quick Ratio (MRQ) | 1.61 | 1.17 | 1.29 |

| Current Ratio (MRQ) | 1.65 | 1.3 | 1.6 |

| LT Debt to Equity (MRQ) | 88.13 | 41.51 | 35.31 |

| Total Debt to Equity (MRQ) | 88.13 | 60.27 | 65.8 |

| Interest Coverage (TTM) | 26.79 | 54.4 | 13.2 |

The Bottom Line

The takeaway for investors is that understanding how to review a firm’s assets is a valuable part of security analysis. The analysis cannot be in a vacuum as a company must be analyzed over time, such as quarterly or over a number of years by looking at its historical financials. A firm must also be compared to key rivals, which can help uncover inconsistencies or areas for further analysis.

Subscribe to our mailing list to get the updates to your email inbox.. Just Enter your email id below and click on subscribe button! After that, verify it through the verification email received on your email id and start learning more!..

Subscribe to our mailing list to get the updates to your email inbox.. Just Enter your email id below and click on subscribe button! After that, verify it through the verification email received on your email id and start learning more!..

beautiful article ! :)

ReplyDelete