1. Service

Tax - Introduction

It is quite surprising to know that unlike other central taxation laws like Central Excise Act, 1944; Customs Act, 1962; Income Tax Act, 1961; Central Sales Tax Act, 1956; etc; there is no specific act like Service Tax Act. The power to levy service tax is derived by the Central Government vide residual entry No. 97 of Schedule VII of the Constitution of India. Service Tax is levied, collected and administered under Chapter V of the Finance Act, 1994 (hereinafter referred to as the Act). It extends to whole of India except the state of Jammu & Kashmir.

Service

Tax is, as the name suggest, a tax on services. It is an indirect tax, akin to

excise duty and sales tax, where the incidence of tax is passed on to the

consumer. It is significantly different from excise duty and sales tax, where

the tax is levied on goods, which are tangible. The taxable event for levy of

service tax is the rendering of service, which is intangible.

Since introduction of Service Tax in the year 1994 (when initially only three service were taxable), the concept was based on selective approach, wherein the services specified (positive list) under Section 65(105) of the Act (as amended) were taxable.

The

Finance Act, 2012 has made a paradigm shift in the taxation of services. In the

new concept, popularly known as Negative List approach, all the services provided or agreed to be

provided in the taxable territory are taxable, unless they are specified

under the negative list entry or otherwise exempted. This has tremendously broadened the scope of levy of service tax.

The negative list approach is made applicable w.e.f. 01-07-2012. Section 66B of

the Act is the charging section which prescribes the rate of service tax as

12%. After adding the Primary Education Cess of 2% on service tax and Higher

Secondary Education Cess of 1% on service tax, the effective rate of service

tax, is 12.36%. [Refer Para 10.1]

In this

Article, the author has attempted to reply, to some of the queries, in

Frequently Asked Questions (FAQ’s) format, related to service tax on ‘Goods

Transport Agency Service’ with reference to the new negative list approach. It can be used as a guide to service tax on GTA which is one of

the most litigated services.

2. Service Tax on GTA - Background

The levy of Service Tax on Road Transportation Service has always remained subject matter of uncertainty and litigation. Earlier, The Finance Act, 1997 had levied Service Tax on Goods Transport Operators w.e.f. 16-11-1997 which was subsequently withdrawn after nation-wide strike. Thereafter by the Finance (No. 2) Act, 2004 Service Tax has been imposed on Transport of Goods by Road service rendered by any goods transport agency with effect from 10-09-2004. However, the levy was deferred till further notice again in view of transporters strike. The Government thereafter constituted a committee to study the matter. Taking into account the recommendations of the Committee, Notification Nos. 32 to 35/2004 – ST all dated 03-12-2004 were issued, finally levying tax of Transport of Goods by Road with effect from 01-01-2005.

3. Definitions

3.1 Who is a GTA - Goods Transport Agency?

As per Section 65B(26) of the Finance Act, 1994; "Goods Transport Agency means any person who provides service in relation to transport of goods by road and issues consignment note, by whatever name called”. Therefore, issue of Consignment Note (C/N) is integral and mandatory requirement before any road transport can be said to be GTA.

The use

of the phrase ‘in relation to’ has extended the scope of the definition of GTA.

It includes not only the actual transportation of goods, but any

intermediate/ancillary service provided in relation to such transportation,

like loading/unloading, packing/unpacking, transshipment, temporary

warehousing, etc. If these services are not provided as independent activities

but are the means for successful provision of GTA Service, then they are also

covered under GTA and abatement allowed.

In the

positive list approach, by statutory provision, GTA service was taxable if

provided in a ‘goods carriage’ as defined therein. There is no such explicit

condition in the negative list approach.

3.2 What is a Consignment Note?

Consignment Note is not defined in the Act. As per Explanation to

Rule 4B of Service Tax Rules, 1994; consignment note means a document, issued by a goods transport agency against the receipt of goods for the purpose of transport of goods by road in a goods carriage, which is serially numbered, and contains the name of the consignor and consignee, registration number of the goods carriage in which the goods are transported, details of the goods transported, details of the place of origin and destination, person liable for paying service tax whether consignor, consignee or the goods transport agency.

3.3 Who is a Courier Agency?

As per section 65B(20) of the Act, “courier agency means any person engaged in the door-to-door transportationof time-sensitivedocuments, goods or articles utilising the services of a person, either directly or indirectly, to carry or accompany such documents, goods or articles”.

Note: A

courier agency is not restricted to transportation of goods by road. It can

transport any documents, goods or articles by any mode of transport such as

air, road or water.

3.4 Is it mandatory to issue Consignment Note?

Yes, Rule 4B ibid mandates issue of C/N by any goods transport agency which provides service in relation to transport of goods by road in a goods carriage to the recipient of service. In case of default, penalty upto Rs. 10,000/- may be imposed u/s 77 of the Act. However, it is not mandatory for a courier agency to issue a consignment note.

4. Negative List

4.1 Whether each and every transportation of goods by road is taxable for all persons?

No. Services by way of transportation of goods by road are taxable, ONLY IF the same is provided by (i) a goods transportation agency; or (ii) a courier agency. Services of Road Transport provided by all others are not taxable because they are covered by the Negative List u/s 66D(p)(i) of the Act. In other words, if any person is providing service of transportation of goods by road, and is neither covered under the statutory definition of GTA, nor under courier agency, then he is not liable to pay any service tax on such transportation.

5. Reverse Charge on GTA

5.1 We are a Partnership Firm. We purchased Plant & Machinery from Kolkata and paid freight of Rs. 20,000/-to the transporter. Our chartered accountant informed that we are legally required to obtain service tax registration and pay service tax on Rs. 20,000/-!!!!Why? We are not providing any service?

Your C.A. is absolutely correct. Normally, the liability to pay service tax is on the person providing the service. But, by fiction of law, section 68(2) of the Act has empowered the Central Government to notify such services, on which the liability to pay service tax, to the extent specified, shall be shifted from the service provider to the service recipient. This is popularly known as Reverse Charge Mechanism (RCM). Notification No. 30/2012-ST dated 20-06-2012 has been issued which covers GTA service and shifts full (100%) liability of service tax on the service receiver. Any person located in taxable territory, who pays or is liable to pay freight is treated as service receiver.

5.2 Does the same rule apply to individual/proprietorship firm paying freight?

No. As per Entry No. A(ii) of N/No.-30/2012, reverse charge is applicable only when taxable service provided or agreed to be provided by a goods transport agency in respect of transportation of goods by road, where the person liable to pay freight is,—

a) any factory registered

under or governed by the Factories Act, 1948 (63 of 1948);

b) any society registered

under the Societies Registration Act, 1860 (21 of 1860) or under any other law

for the time being in force in any part of India;

c) any co-operative society

established by or under any law;

d) any dealer of excisable

goods, who is registered under the Central Excise Act, 1944 (1 of 1944) or the

rules made there under;

e) any body corporate

established, by or under any law; or

f) any partnership firm whether

registered or not under any law including association of persons;

So, it can be clearly seen

that an individual/proprietorship firm is not covered in the above ‘specified category’. It means, if the freight

is paid (either himself or through his agent) by an individual/proprietorship

firm or HUF then the service tax thereon shall be paid by the GTA itself.

Note: N/No.-30/2012 is effective from 01-07-2012. But, even before that, reverse charge was applicable on GTA and instead of ‘person liable to pay freight’, it earlier covered ‘if the consignor or consignee’ is a specified category. The specified category as prescribed earlier was slightly different from the current specified category.

ILLUSTRATION:

A goods transportation agency transports a consignment of M.S. Rod from Rourkela to Mumbai. The consignor is a public limited company and the consignee is an unregistered partnership firm. The goods shall be used in construction of a single residential house. As per the agreement, freight shall be payable by the consignee. The consignment note is prepared on ‘TO PAY’ basis. Who is the person liable to pay service tax?

One of the ‘specified category’ is a partnership firm whether registered or not under any law. Here, the person liable to pay freight is a ‘specified category’, so reverse charge is applicable. The service tax shall be paid by the partnership firm. The end use of goods is generally not relevant for taxing GTA service (Except few instances, say when it is provided to the United Nations or a specified international organization, SEZ, etc.)

A goods transportation agency transports a consignment of M.S. Rod from Rourkela to Mumbai. The consignor is a public limited company and the consignee is an unregistered partnership firm. The goods shall be used in construction of a single residential house. As per the agreement, freight shall be payable by the consignee. The consignment note is prepared on ‘TO PAY’ basis. Who is the person liable to pay service tax?

One of the ‘specified category’ is a partnership firm whether registered or not under any law. Here, the person liable to pay freight is a ‘specified category’, so reverse charge is applicable. The service tax shall be paid by the partnership firm. The end use of goods is generally not relevant for taxing GTA service (Except few instances, say when it is provided to the United Nations or a specified international organization, SEZ, etc.)

ILLUSTRATION:

ABC Ltd. sells the goods to XYZ Ltd. The freight for transportation of the goods has been paid by ABC Ltd to the GTA. The consignment note is prepared on ‘FREIGHT PAID’ basis. ABC Ltd. collects this freight from XYZ Ltd., on actual basis, by separately showing it in the invoice, which is paid by XYZ Ltd., to ABC Ltd. Who is liable for payment of Service Tax?

ABC Ltd. is the person liable to pay freight. It cannot be said to be paying the freight on behalf of XYZ Ltd. ABC Ltd. is only getting reimbursement of the freight paid by it, initially. As such, the liability for payment of service tax will only be on ABC Ltd.

5.3 It means an Individual/Proprietorship Firm can pay any amount of freight to any GTA without any service tax implications?

Yes, if

the same is neither a factory, nor a registered dealer under Central Excise

Act, 1944.

Practical Issue: As

mentioned in Para 2.2, the consignment note should indicate that whether

consignor, consignee or the GTA shall be paying service tax on the consignment.

It is the duty of the GTA to ascertain, in each case, the person liable to pay

freight as per the agreement, check if such person is covered under specified

category and accordingly mention the person liable to pay service tax in C/N as

per law. In practical situation, it would be very difficult for GTA, especially

when freight is to be paid by an individual/proprietorship firm. How can a GTA

know that such a person is registered or governed under the Factory Act, 1948

or is a registered dealer of central excise? Should he take certified true copy

of such registration certificate for each such person and in case of

non-registration, a declaration to such effect?

5.4 We have entered into a contract with a very renowned and big size GTA which is a Public Limited Company for transportation of raw materials to our factory. They are registered with the service tax department. Who is liable to pay service tax?

For application of reverse charge, the size and status of the GTA providing transportation service is irrelevant. Since you are a factory (specified category), paying the freight, you shall discharge the service tax liability.

5.5 What if the service tax is charged separately by the GTA in C/N or Bill?

The reverse charge liability under section 68(2) of the Act is a statutory liability imposed by law. The liability of service provider and service receiver is different and independent of each other. Even when the service provider (GTA) has wrongly charged service tax in bill, the liability of service receiver is not discharged. So, it is suggested that the person paying freight shall deduct service tax charged by the GTA and pay only the freight amount to the GTA. The service tax on GTA shall be deposited directly by the service recipient to the government exchequer.

5.6 Whether reverse charge is applicable on courier agency?

No, courier agency is not covered under reverse charge. Any person receiving services of a courier agency are not liable to pay service tax on payment of courier charges.

6. Place of Provision of GTA Service

6.1 What

is the place of provision of a service of transportation of goods?

As per Rule 10 of Place of Provision of Services Rules, 2012, Place of provision of a service of transportation of goods is the place of destination of goods, except in the case of services provided by a GTA in respect of transportation of goods by road, in which case the place of provision is the location of the person liable to pay tax (as determined in terms of Rule 2(1)(d) of Service Tax Rules, 1994).

6.2 Who is a person liable to pay tax?

Rule 2(1)(d) of Service Tax Rules, 1994 provides that where a service of transportation of goods is provided by a‘goods transportation agency’, and due to reverse charge [Refer Para 5.2] , the person liable to pay tax is the person who pays, or is liable to pay freight (either himself or through his agent) for the transportation of goods by road in a goods carriage. But, if the person liable to pay freight is located in non-taxable territory, then the person liable to pay service tax shall be the service provider. [Proviso to Rule 2(1)(d) ibid]

In simple

words, in all the cases of transportation of goods by road, by GTA, where the

location of the person liable to pay freight is in the state of Jammu&

Kashmir or Outside India, the person liable to pay service tax is GTA itself.

ILLUSTRATION:

A goods transportation agency, GTA Ltd. is located in Bhubaneswar. It transports a consignment of steel ingots from Rourkela to a Steel Rolling Mill in Jammu (Non-Taxable Territory). As per the agreement, the freight shall be payable by the rolling mill in Jammu. The consignment note is prepared on ‘TO PAY’ basis. Who is the person liable to pay service tax?

The service tax shall be

paid by GTA Ltd. because the person liable to pay freight is located in Jammu

which is in non-taxable territory and as per proviso to Rule 2(1)(d) ibid, the

person liable to pay tax is the service provider i.e. GTA Ltd.

7. Threshold Exemption

7.1 I have heard that just like basic exemption of Rs. 2 Lacs in Income-tax, there is a threshold exemption of Rs. 10 Lacs in service tax. Is it correct?

Yes,

there is threshold exemption of Rs. 10 Lacs available under N/No. – 33/2012-ST,

but the same is allowed only to the service provider. The service recipient

liable to pay tax under RCM, on services covered u/s 68(2) has been

specifically excluded to avail the threshold exemption.

In strict

legal terms, suppose a partnership firm of chartered accountants or advocates

is setting up a new office. They paid freight of Rs. 1,501/- to GTA on

transportation of furniture & fixtures purchased for the office. For such a

trivial transaction, the partnership firm must obtain service tax registration

and pay tax thereon and file half yearly return!!! This is quite illogical and

harsh requirement, particularly for the small assessee’s, but that’s law.

The trade

associations/ chamber of commerce should send representation to the Central

Government to allow some threshold exemption to the service recipient liable to

pay tax under reverse charge. It would prevent small assessee’s from genuine

hardship. This may also save a lot of unknowing defaults resulting into

litigations, which could put extra pressure on judiciary.

8. Exemptions – Value / Item Based

8.1 Whether service tax leviable on every consignment by GTA, including local transporting, where the freight charged is very low?

No. Mega

Exemption Notification No. 25/2012-ST has exempted low value consignments from

the levy of service tax, as follows: (a) Where the gross amount charged for the

transportation of goods on a consignment transported in a single goods carriage is upto Rs

1,500/-; or (b) Where the gross amount charged for transportation of all such

goods for a single consignee in

the goods carriage is upto Rs. 750/-

Note:

Many authors have interpreted that the exemption of higher limit of Rs. 1500 is

available if the goods carriage is transporting goods of single consignee. But

in my view, the higher exemption is available even when the goods carriage is

transporting goods of more than one consignee, if the gross amount charged from

all the consignee’s for single goods carriage is upto Rs. 1500.

ILLUSTRATION:

A company receives goods from a GTA in a truck. No other goods are loaded in that truck. The company pays freight of Rs. 1500/- to GTA. No service tax is payable by any person on this consignment as it is exempted.

ILLUSTRATION:

A company receives goods from a GTA in a truck. Some other goods not belonging to the company are also loaded in the truck. The company pays freight of Rs. 900/- to GTA. The freight of other goods is Rs. 500/-. Service Tax is not payable by the company on this consignment as the total freight for the truck is Rs. 1400 (<1501) so it is exempted.

ILLUSTRATION:

In the above illustration, if the freight of other goods is Rs. 700/-, then the total freight for the truck is Rs. 1600 (>1500). Freight paid by company is Rs. 900 (>750). So, exemption is not available and the company should pay service tax on Rs. 900/-!!

Practical Issue: What could be the documentary proof that the goods carriage is transporting goods belonging to only single consignee or more than one consignee!! Should the consignor/consignee take a certificate from the GTA that vehicle did not carried any other goods?

8.2 A proprietorship firm trading in steel is registered under central excise as dealer, has paid freight for a quarter as below. What is the service tax liability?

Here, the

proprietorship firm is liable to pay service tax under reverse charge as it is

registered under central excise. The consignment in a single vehicle with

freight upto Rs. 1,500 is fully exempted. So, service tax on balance Rs.

5,31,000/- @ 3.09% = 16,408/-

8.3 In the above example at Para 8.2, if the proprietorship firm is not registered under central excise, then what are the consequences?

Then, RCM is not applicable and the service tax shall be paid by the respective GTA, after considering the exempted consignments. Assuming that a single GTA is involved in the above case, the GTA is liable to pay tax amounting to Rs. 16,408/-

8.4 Is there any other exemption available on GTA Service?

Yes. N/No. 3/2013-ST dated 01-03-2013 has amended the N/No. 25/2012 w.e.f. 01-04-2013, extending exemption for services provided by a GTA, by way of transport in a goods carriage of;

i. agricultural produce;

ii. foodstuff includingflours, tea, coffee,

jaggery, sugar, milk products, salt and edible oil, excluding alcoholic

beverages;

iii.

chemical fertilizer and oilcakes;

iv.

newspaper or magazines registered with the Registrar of Newspapers;

v. relief

materials meant for victims of natural or man-made disasters, calamities,

accidents or mishap; or

vi.

defense or military equipments;”

This

amendment is a positive for the FMCG and food companies like Hindustan

Unilever, Nestle, ITC, Perfetti, Kellogs, etc. and those manufacturing or

trading/dealing or retailers (including departmental stores like Big Bazaar,

Vishal Mega Mart, etc.) in these products. It is pertinent to mention that

prior to this amendment; the exemption was available on fruits, vegetables,

eggs, milk, food grains or pulses in a goods carriage.

8.5 We are wholesale dealers of food items like rice, wheat, sugar, refined oil, mustard oil, jeera, etc. Are we liable to pay service tax on freight paid on transportation of these food items?

No. Neither service receiver, nor service provider (GTA) is liable to pay service tax as the transportation of these items is exempted.

9. Registration of GTA

9.1 Whether it is compulsory for a GTA to take registration for service tax?

As per section 69(2) of the Act, registration is compulsory, when the aggregate value of taxable services, provided from all the premises, of all descriptions, exceeds Rs. 9 Lacs. So, a GTA need not apply for service tax registration until the limit of Rs. 9 Lac is reached. While calculating the limit of Rs. 9 Lac, the GTA service where reverse charge is applicable is to be excluded.

9.2 Does it mean that a GTA providing all transportation service to persons covered under RCM is not required to obtain service tax registration?

Yes, because he is neither liable to pay tax, nor his aggregate value of taxable services exceed Rs. 9 Lacs. As per circular no. 341/18/2004-ST dated 17-12-2004, according to provisions of section 69 of the Act, requirement of registration is limited to persons liable to pay service tax. Thus those goods transport agencies, which are not liable to pay any service tax, are not required to be registered under the service tax rules.

9.3 Whether it is compulsory for a recipient of GTA service to take registration for service tax?

Yes, if reverse charge is applicable, service recipient becomes liable to pay service tax and section 69(1) of the Act mandates that every person liable to pay tax shall obtain service tax registration. The application shall be made in Form ST-1 within 30 days of arising of liability. The Range Superintendent shall issue the registration certificate in Form ST-2. The half-yearly returns are required to be filed in Form ST-3 by 25th October/April every year for 1st & 2nd Half respectively.

10. Abatement on GTA

10.1 What is abatement on GTA?

The dictionary meaning of abatement is‘diminution in amount, degree or intensity; moderation’ or reduction. Notification No. 26/2012-ST dated 20-06-2012 has allowed abatement of 75% on GTA. It means that if the value of GTA service (freight) is Rs. 100, service tax is exempted on Rs. 75 and service tax @ 12.36% (including Ed. & SHE Cess) shall be paid only on the balance value of Rs. 25. So, effective rate of service tax on GTA service is 3.09% of total freight.

10.2 Who can avail abatement?

The abatement can be availed by the person liable to pay service tax on GTA. In other words, in case of reverse charge, the service recipient can avail abatement and pay tax @ 3.09% and when reverse charge is not applicable, than the GTA can avail abatement and pay tax @ 3.09%

10.3 What are the conditions for availing abatement?

The abatement is available subject to the condition that the CENVAT credit on inputs, capital goods and input services, used for providing the taxable service, has not been taken under the provisions of the CENVAT Credit Rules, 2004.

Note: In

the positive list approach, due to a lot of litigations and practical

difficulty in proving non-availment of cenvat credit by the GTA, the government

had allowed unconditional abatement of 75% w.e.f. 01-03-2008 vide N/No.

13/2008-ST, and dropped the similar condition as in Para 10.3. But, it has

re-appeared in the negative list regime w.e.f. 01-07-2012 vide N/No.

26/2012-ST!!!

11. Cenvat Credit

11.1 A manufacturing company is paying freight on transportation of raw materials upto its factory. Can it avail abatement and cenvat credit simultaneously?

Yes, any service receiver can avail abatement and pay tax @ 3.09% and still take cenvat credit of such tax, if the GTA service is otherwise eligible as ‘input service’. In case of outward freight, cenvat credit is not available for freight paid beyond the ‘place of removal’. The above condition in Para 10.3 restricting the cenvat credit is for the service provider using any inputs, capital goods or input services for providing such services.

11.2 How can a service recipient ascertain that the GTA has not taken cenvat credit?

The service recipient should obtain a declaration/certificate from the GTA that they have not availed cenvat credit on inputs, capital goods and input services, used for providing the taxable service. In the absence of such a declaration, the Assessing Officer may deny the benefit of abatement and can raise demand. It is suggested that the GTA should have a declaration pre-printed in its consignment note. [Refer Note to Para 10.3]

11.3 A person has cenvat credit balance available for utilization. Can he utilize cenvat credit for payment of service tax on GTA under reverse charge?

No, the service recipient is not allowed to utilize cenvat credit for payment of service tax under reverse charge. [Explanation to Rule 3(4) of Cenvat Credit Rules, 2004]. Thus, the service recipient must directly deposit service tax on GTA through GAR-7 Challan.

11.4 When can a service recipient avail cenvat credit of service tax paid under RCM?

As per 1st proviso to Rule 4(7) of Cenvat Credit Rules, 2004; the service recipient can avail cenvat credit of an input service, where service tax is paid by him on reverse charge, after making payment of value of input service to the service provider and after payment of service tax thereon. Thus, cenvat credit is not available unless payment of value of input service is made.

11.5 What is the relevant document for availing cenvat credit by service recipient?

The cenvat credit is available to service recipient as the person liable to pay tax on the basis of GAR-7 challan evidencing the payment of service tax. [Rule 9(1)(e) of Service Tax Rules, 1994]

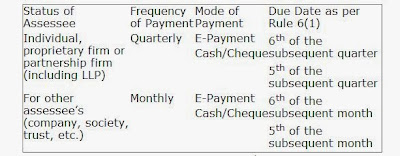

12. Due date for payment of Service Tax

12.1 What

is the due date for payment of service tax?

However,

for the month/quarter ending on 31stMarch,

the due date shall be 31st March

of the same month/quarter. [2ndproviso

to Rule 6(1)]

13. Point

of Taxation

13.1 A

company, which is following mercantile system of accounting, is unable to

decide due date for the following GTA service received by it during the month

of October, 2013

Which is

the relevant date for determining the due date for payment of service tax?

As per

Rule 6(1) ibid; as summarized above, service tax shall be paid to the credit of

Central Government on 6th/5thof the

month/quarter, as the case may be, immediately following the month/quarter in

which the service is deemed to be provided as

per the rules framed in this regard. The Point of Taxation Rules, 2011 has been

framed which defines‘point of taxation’ means the point in time when a service

shall be deemed to have been provided. In case of service recipients liable to

pay tax u/s 68(2) of the Act, due to reverse charge, Rule 7 of the Point of

Taxation Rules, 2011 is applicable.

As per

Rule 7 ibid, the point of taxation is the date

of payment. Therefore, in the above example, the service tax is payable

for Sr. No. 1 & 2 for the month of October and the due date shall be

06-11-2013 [E-Payment]. Thus, date of consignment note, receipt of goods and

bill date is not relevant. However, if the payment is not made within 6 months

from the date of invoice, then the point of taxation shall be the date of

completion of service or date of invoice, whichever is earlier.

14. Default on payment - Voluntary Compliance

14.1 We

have been paying freight on transportation of goods since very long, without

knowing that due to reverse charge, we are liable to pay service tax. We are

not registered with the service tax authorities. What should we do?

The Central Government has launched an amnesty scheme known as Service Tax - Voluntary Compliance Encouragement Scheme, 2013 (VCES). It has given this last opportunity to defaulted taxpayer’s whereby complete waiver of interest, penalty and prosecution is ensured to an applicant. Any person who has ‘tax dues’ for the period 01-10-2007 to 31-12-2012, outstanding as on 01-03-2013, can take the benefit of VCES. An application under VCES can be made on or before31-12-2013. Outstanding tax can be paid in installments but at least 50% of tax due shall be paid upto 31-12-2013. Balance tax can be paid upto 30-06-2014.

Note: The

rate of interest as prescribed u/s 75 of the Act is 18% p.a. and penalty of

upto 100% of tax defaulted is imposable u/s 78. Under Section 70, penalty/late

fee for late/non-filing of return of service tax is upto Rs. 20,000/- for each

return. Prosecution can also be launched in appropriate cases. As reported in

the media, the finance minister has instructed the authorities to send notices

to about 10 Lac non-filers and stop-filers registered with the department,

after the VCES comes to an end.

14.2 We are in receipt of a Show-Cause Notice dated 10-03-2013 u/s 73 of the Act. Are we eligible to take benefit under VCES?

Yes, You Are!!! If the service tax authorities issues or make, upto 28-02-2013; any show cause notice or order of determination demanding payment of service tax, then a declaration shall not be entertained for the tax so demanded. Since the notice is dated 10-03-2013, you are eligible to file application under VCES.

Author

Manoj Agarwal,

Service Tax Consultant,

Ganpati Campus, Lal

Building Road,

Rourkela– 769012

E:Mail: ServiceTaxExpert@yahoo.com,tax2001-it@yahoo.com

Kindly contact for further

clarifications.

Disclaimer: This article is the property of the author. No one shall use

this article for commercial purposes, without the permission of the author. The

author shall not be responsible or liable for anything done or omitted to be

done on the basis of this article.

Subscribe to our mailing list to get the updates to your email inbox.. Just Enter your email id below and click on subscribe button! After that, verify it through the verification email received on your email id and start learning more!..

Subscribe to our mailing list to get the updates to your email inbox.. Just Enter your email id below and click on subscribe button! After that, verify it through the verification email received on your email id and start learning more!..

The above Article has been published by All India Transporters Welfare Association - AITWA in there monthly magazine 'Parivahan Pragati' January - 2014 issue at Page 25. AITWA is one of the largest association of road transporters and its members account for about 75% of the road transportation business in India!!! Moreover, the same will also get published in R.K.Jain's Service Tax Review STR issue dated 15-01-2014 which is referred by almost all the professionals and authorities including High Courts, Tribunals and Commissioners!!!

ReplyDelete